Anaplan Accelerator: Financial Consolidations & Analytics (FC&A)

Featured Anaplan Experts

Accordion’s Financial Consolidations & Analytics (FC&A) Anaplan Accelerator is a fully built financial consolidations solution based on best practices: aggregation, intercompany eliminations, cash flow reporting, non-standard ownership, journal entries, insightful analytics, and flexible FX.

Accordion’s Financial Consolidations & Analytics (FC&A) Anaplan Accelerator is a fully built financial consolidations solution based on best practices: aggregation, intercompany eliminations, cash flow reporting, non-standard ownership, journal entries, insightful analytics, and flexible FX.

Real-time Financial Consolidations to Cut Processing Time and Speed Up the Close

Report on P&L, Balance Sheet, and Cash Flow by configuring to your chart of accounts

Report on P&L, Balance Sheet, and Cash Flow by configuring to your chart of accounts- Aggregation through entity structures and other segments without running rules or scripts

- Perform and track intercompany eliminations at the first common parent

- Apply partial ownership logic that can be changed by month to allow for flexibility over time

Note: Want a closer look? Click on the screenshot to enlarge it.

Clearly Understand the Impact of FX on Your Business

- Enable multiple currencies to see full company financials translated and reported

- Apply average or end of month rates, as well as currency overrides on the balance sheet for areas such as

- APIC or investment in subsidiaries

- See the impact of FX movements on the cash flow

- Easily apply alternate rate sets to enable “what if” currency analysis on the fly

Note: Want a closer look? Click on the screenshot to enlarge it.

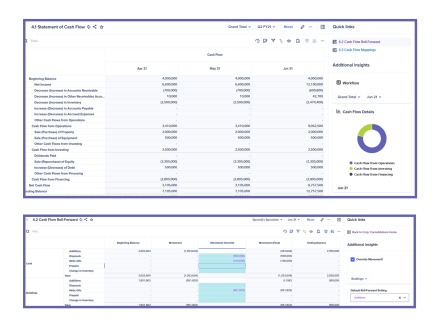

Streamline Reporting and Auditability with Easy to Understand Cash Flow

Use balance sheet and P&L data to calculate cash flow in real time as balances change

Use balance sheet and P&L data to calculate cash flow in real time as balances change- Map changes in balance sheet accounts to specific movement categories and cash flow accounts

- Allow end-users to view mappings and better understand how the cash flow lines are derived

- Adjust movement categories from the default mapping in areas where mappings cannot fully classify account movements (PP&E for example)

Note: Want a closer look? Click on the screenshot to enlarge it.

Better Understand Data Changes With In-Model Topside Journal Entries and Robust Financial Controls

Book journal entries to adjust data sourced from general ledgers, make reclassing entries, or adjust data to satisfy varying reporting requirements (IFRS vs. GAAP)

Book journal entries to adjust data sourced from general ledgers, make reclassing entries, or adjust data to satisfy varying reporting requirements (IFRS vs. GAAP)- Configure workflow to allow for separation of duties between creating, reviewing, and posting entries

- Leverage Anaplan’s built in audit features to see complete history for any data point changes

- Easily roll back the system to any point in time, rather than relying on periodic backups

Note: Want a closer look? Click on the screenshot to enlarge it.

Manage Your End-to-End Close Process With Task Management and Account Reconciliations

Utilize the close task checklist to quickly understand bottlenecks in monthly close cycles

Utilize the close task checklist to quickly understand bottlenecks in monthly close cycles- Task management includes user assignment, workflow, approvals, and reporting

- Perform and sign off on account reconciliations, with ability to explain balances, assign risk ratings, and track accountability

- Import general ledger and subledger balances to perform balance comparisons, or use account analysis to explain balance changes

Note: Want a closer look? Click on the screenshot to enlarge it.

Accordion's Anaplan Solution Accelerators

In addition to the “Financial Consolidations & Analytics (FC&A)” accelerator featured above, Accordion offers a variety of “Anaplan Accelerators” prebuilt to expedite your deployment process, improve ROI, and reduce implementation risk. Explore them:

Accelerated P&L Planning (APP)

A fully built P&L planning solution based on best practices: driver-based forecasts, historical trending, insightful analytics, and comparative reporting.

Learn MoreHospitality Management

An Anaplan solution tailored for the management and analysis of hospitality industry planning, including: key metric analysis, occupancy rate and price forecast, and P&L reporting.

Learn MoreEnterprise Compensation Planning

A dynamic workforce planning and management solution for both top-down and bottom-up planning including: driver-based forecasting, what-if scenario planning, and employee compensation management.

Learn MoreGross-to-Net Chargeback Forecasting & Analytics

An automated chargeback modeling solution that streamlines the gross-to-net planning process, including: unit trending, calculating distributor fees, returns, and rebates, along with full chargeback and gross-to-net analytics.

Learn MoreReal Estate Management & Forecasting

An Anaplan solution built for businesses in the real estate sector, including: a high level summary dashboard, detailed key metric analysis, property management, depreciation scheduling, and more.

Learn MoreCapital Asset Management

An Anaplan solution for in-depth asset management for businesses in any sector, including: a high-level summary dashboard, full capital asset planning, detailed expense breakdowns, depreciation scheduling by asset, financing analysis, and more.

Learn MoreTelecom Planning & Analytics

A fully built P&L planning solution tailored to the telecom industry, including: subscriber forecasting, ARPU analytics and what if analysis, driver-based telecom expense planning, workforce comp planning, and fully featured comparative reporting.

Learn MoreTitle (Publisher) Planning

A title planning solution custom built for the publishing industry, including: gross-to-net ISBN and title series forecasting, historical unit trending, royalty calculations, and full P&L reporting.

Learn MoreSaaS Revenue Modeling

An Anaplan solution built for SaaS businesses to easily source CRM data and drive real-time forecasting, including: CRM Integration, opportunity management, renewal management, and ad conversion forecast pipeline summary.

Learn More