Carve-Out Planning & Execution

Accordion's Approach to Carve-Outs

At Accordion, we harness our exclusive focus on private equity to guide sponsors and their management teams through the carve-out lifecycle.

Unlike your typical consultants, we don’t just spearhead strategy (though we do that quite well). We’re known for having our sleeves perpetually rolled up – working alongside PE sponsors and management teams to plan and execute carve-out acquisitions through diligence, signing, closing, and TSA exit. Here’s how:

DOING THE DILIGENCE

Our eyes are always on value – and to get the most value out of the business, we start early. By identifying risks, vetting standalone/one-time costs, and advising on the TSA, our team will help optimize the purchase price.

READYING FOR DAY 1

You name it, we handle it. From directing all functional workstreams through management of the SMO; to owning the finance and IT lanes; to operationalizing the TSA; our work allows management to focus on the business itself.

STANDING UP

It’s one thing to stand up a back office; it’s another to do it quickly and thoroughly. We design and execute operating models to stand up the business’ overhead functions – all while preventing disruption to operations.

OPTIMIZING VALUE

Adjusting to institutional ownership can be tricky; our team makes it easier. By providing unrivaled finance, accounting, and IT expertise, we drive value-creating initiatives that help sponsors realize their investment thesis.

Featured Case Studies

Been there, carved that.

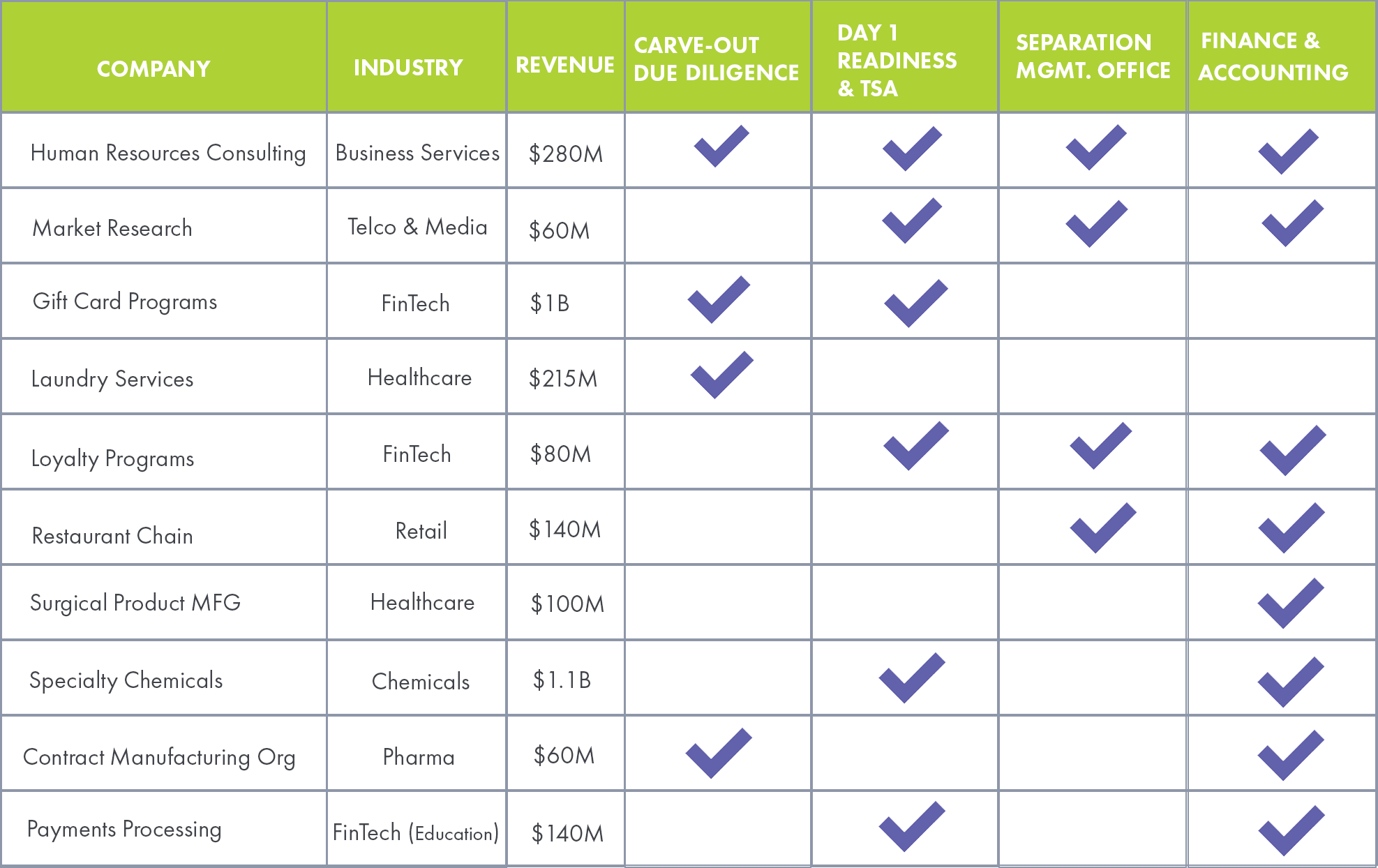

When it comes to carve-outs, our people have been around the block. From buy-side to sell-side, we’ve held interim management positions and led Separation Management Offices and functional departments – not only as advisors, but also as operators within transacting portfolio companies. Channeling this deep M&A expertise, along with our finance and accounting prowess, we’ve successfully led the following carve-outs (among others).