Guest comment: Benjamin Lehrer on threats to private equity | Print Edition | Private Equity International

Winter is coming: Mid-market private equity firms must adapt to new ways of thinking or risk ending up on the wrong side of history.

We’ve reached the turning point. Capital overhangs cause deal chasing and nosebleed auction multiples are now the standard. The off-market deal is the golden goose, yet attractive companies have little reason to shy away from sale processes. PE firms don’t want to miss out on four to six years of fees and upside as funds transition to harvest periods, so expect that capital to be put to work, one way or another.

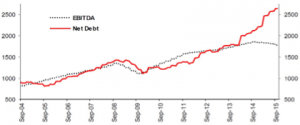

Unfortunately, business performance isn’t matching the multiple exuberance. S&P 1500 Ex-Financials EBITDA peaked at the end of 2014, yet net debt has exploded with loose credit conditions and a focus on return of capital to shareholders, rather than capex (see top chart). Rarely, if ever, have net debt and EBITDA growth diverged so dramatically – if the US economy falters, there is little room for error.

Institutional investors are not blind – and ‘blind pool’ investing with a 10-year lock-up is losing its lustre. Larger investors are wielding the power of their capital to secure no-fee co-investment rights. Downmarket, family offices are building their own direct investment engines.

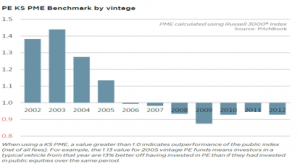

So why has the PE model worked for so long? Performance. While two and 20 is an aggressive comp model, most investors lack an alternative to access the asset class. However, following decades of outperformance against stocks, fund vintages have underperformed their public market peers since the 2006-07 market peak prior to the global financial crisis (see bottom chart).

Top performers continue to attract capital in the traditional fee model, but what about everybody else? Two and 20 looks okay with IRRs in the high teens and above, but how does it look under 10 percent? The next turn of the cycle will be punishing, especially if investors view lower returns as a new normal for the asset class. Add in benchmarking, where half of funds will lag their peers and struggle in fundraising, and you have the perfect storm.

Will this winter choke off private equity? No – just the opposite. Traditional asset classes remain in a prolonged period of uncertainty, and US demographic trends are a positive for private equity. Retiring baby boomers need buyers for their successful businesses, and private equity is a natural liquidity provider. Funds of all sizes are targeting these transitioning businesses. However, mid-market firms will feel the squeeze. Larger players are moving downmarket for platform add-ons and smaller deals, and there is rising competition from non-fund sources with deal flexibility and ways to establish working relationships beyond upfront transaction catalysts.

Successful PE investments are driven by six things: successful sourcing; efficient underwriting; selection of strong management teams; improved portfolio company operations; organic and inorganic growth realization; and interpretation of macro trends driving entry and exit points. Solid track records are a function of nailing all these, yet GP teams need not bear all the burden themselves. Top-tier firms will differentiate through competency allocation, particularly through new ways of accessing third-party sourcing channels and operational improvement expertise.

Dealflow wins. Dedicated business development professionals are now PE fixtures, something rarely seen when funds were scarce and deals aplenty. Industry and market relationships are a necessity, but another dealflow approach is growing – having others do it for you. Innovative advisory offerings and independent sponsor deals are playing a bigger role in the lower end of the market, where GPs are not set up to transact efficiently. After all, a $25 million transaction requires the same process as a $200 million one. For GPs pushing down-market, the answer is not to double or triple their bench, especially if fees are under pressure.

PE-savvy professionals are creating new models to help companies manage growth, determine optimal capitalization, and streamline PE partner selection and transaction execution. They are solving the capital readiness gap defined by murky financials, loose management processes, and a lack of information flow and systems. PE won’t fill this role, as their limited partner agreements often exclude such activities – ultimately, they’re not consulting firms. Private equity firms are holding on to their investments longer and relying more on portfolio companies’ operational improvement to drive returns. Financial engineering has its limits, banks face increasing regulation, and balance-sheet wizardry cannot be counted on as a long-term return generator.

Operational improvement is another area poorly suited to the GP. Unlike the transaction engine drawing constant bandwidth, portfolio company initiatives tend to be project-driven. The opportunity cost of using GP resources is high, while SEC oversight on expense charge-throughs adds an administrative burden.

The answer is third-party expertise. Newer consulting firms are building their value propositions specific to private equity’s needs, easing sponsor-portfolio company communication friction while focusing on tactical, value-creating solutions. Structured as a seamless extension of their own GP teams, private equity now has the tools to run lean and address the realities of longer hold periods.

The coming winter will bring about structural changes to a PE model which has held steady for a generation. While harsh seasons bring challenges, adaptation and innovation will find a way. Private equity remains a critical asset class for investment portfolios and will continue to grow – the winners recognize the threats and will leverage lean, laser-focused teams while embracing outside expertise. Funds that see just another cycle risk seeing their houses wiped from the map. Are you ready to act?

Winter is coming: Mid-market private equity firms must adapt to new ways of thinking or risk ending up on the wrong side of history.