Kreutzer’s Take: Covid Adds to Job Worries of Portfolio-Company CFOs

Chief financial officers at private equity-backed companies faced more pressure from owners who emphasized growth as the economy rebounded from Covid last year.

One of the toughest jobs in private equity got even harder last year as many businesses emerged from the worst of the Covid pandemic.

Long before Covid, chief financial officers at private-equity backed companies faced their share of challenges, often as the executives charged with implementing cost savings or growth initiatives, all while providing frequent updates for their private-equity owners. When the pandemic first struck, many companies and their owners immediately went into survival mode and scrambled to bolster and preserve their liquidity, putting more pressure on CFOs.

Although liquidity concerns have eased, as private-equity firms refocus on expansion, the shift to remote work, rekindled inflation and supply-chain woes as well as a continuing talent crunch, all further complicate the work of portfolio-company CFOs, as they evaluate a resurgence of growth opportunities.

“The fault lines have only been exacerbated by Covid,” said Nick Leopard, founder and chief executive officer of Accordion Partners, a finance and technology consulting firm focused on private-equity companies and their portfolio holdings. CFOs aren’t interacting face-to-face each day with owners, business-unit leaders or company staff, and sponsors zero in on particular details or make demands from a distance, Mr. Leopard added.

“You’re spitballing on certain insights into the business, on certain decisions that need to be made, and you’re doing it all remotely,” he said.

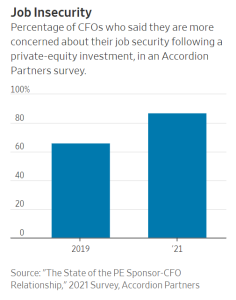

That’s resulted in more widespread concerns among CFOs about job security. A recent Accordion report showed that 87% of some 100 CFOs at private-equity backed companies surveyed late last year said they worry about losing their jobs following a private-equity deal. That’s up from 66% in a similar 2019 survey. The latest data also reflects input from 100 private-equity executives.

That’s resulted in more widespread concerns among CFOs about job security. A recent Accordion report showed that 87% of some 100 CFOs at private-equity backed companies surveyed late last year said they worry about losing their jobs following a private-equity deal. That’s up from 66% in a similar 2019 survey. The latest data also reflects input from 100 private-equity executives.

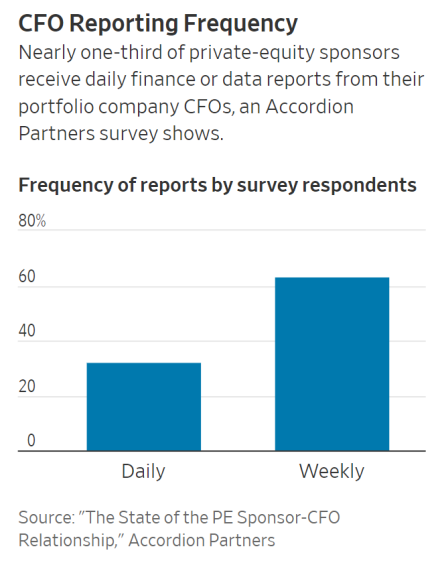

With the pandemic, many private-equity firms began demanding more frequent—even daily—financial reports from portfolio-company CFOs. Although several CFOs say the urgency and frequency of such requests eased as Covid showed signs of abating last year, nearly a third of private-equity executives surveyed said they wanted daily reports, while 63% said weekly reports suffice.

“At one time, there was a daily war room on liquidity in the private-equity portfolio companies, and we were waiting for data to come in on a daily basis,” said Brian Gladden, a former operating partner at Bain Capital who early last year became CFO at Zelis Healthcare Inc., a financial technology provider backed by Bain and Parthenon Capital Partners. “We have not sustained at that level, and we have made it through the toughest part, but it has led to more frequent check-ins,” he said.

Gleeson Van Riet, a financial consultant who serves as an interim CFO for a private-equity backed technology company, said the financial sponsors of the company he works for initially wanted a daily flash report for certain financial data. However, ultimately he convinced them that a weekly report would be more useful, partly because he didn’t receive weekend daily data for certain financial metrics until Tuesdays.

“People had to go through what they went through last year to realize [they] don’t want a bunch of daily data,” said Mr. Van Riet, who previously held CFO positions with energy companies such as SilverBow Resources Inc. and the former Sanchez Energy Corp.

“People had to go through what they went through last year to realize [they] don’t want a bunch of daily data,” said Mr. Van Riet, who previously held CFO positions with energy companies such as SilverBow Resources Inc. and the former Sanchez Energy Corp.

The added pressures facing private-equity backed CFOs have underscored the importance of resources, including technology and people, to help finance teams produce reliable reports. More than 80% of both sponsor executives and CFOs surveyed by Accordion said they don’t have the right systems in place to deliver needed data and analysis.

“It’s hard for a CFO to keep up without the resources,” Mr. Leopard said. “Without a clear plan of attack, CFOs are trying to do it all but not necessarily doing any one thing great.”

Getting the right resources often requires understanding sponsor expectations. Early on in his tenure as Zelis CFO, Mr. Gladden sat down with its directors, including Bain Capital executives, to discuss their specific expectations of the CFO role and what he could do to improve the business.

“I had to hire a certain amount of resources based on those conversations and it allowed me to be better aligned [with the sponsor],” Mr. Gladden said, adding that Zelis set up a new enterprise-resource planning system that goes live this month.

“You need to do that frequently because things change,” Mr. Gladden said. “The business trajectory has continued to be good, but there are different strategic priorities, and I need to be able to make sure I am aligned with what the sponsors are looking for.”

Portfolio company CFOs may no longer be on the Covid hot seat, but the lingering effects have left a lasting mark for many while highlighting resource needs.

Chief financial officers at private equity-backed companies faced more pressure from owners who emphasized growth as the economy rebounded from Covid last year.