COVID-19: The Accordion Framework for PE Sponsors (Part I)

COVID-19: A Practical Framework for Private Equity Sponsors (Part I)

By Nick Leopard, CEO & Founder and Atul Aggarwal, President

As we enter a now inevitable downturn, ‘value’ will become more important than ever. COVID-19 places an ever higher, and more urgent, need to get very surgical and specific about how each portfolio company will survive (over the next few years), and thrive (on the upswing). Without this surgical and specific view, value stabilization at the fund level simply won’t happen, now. And, value creation won’t happen later – on the other side.

In order to make it happen effectively, we need to talk about the right-now granular implications on individual investments and how to manage those in aggregate. In other words: practical advice for sponsors on portfolio operations.

Portfolio of Uncertain Performers

Let’s be clear, this is a singular event for sponsors used to a portfolio where the vast majority of companies are meeting expectations. Sure, there’s always the underperformer (or 2 or 3 or 4) – the portfolio company whose progression has stalled or gone sideways, but they’re more the exception than the rule.

The pandemic – and the related financial instability – won’t necessarily mean that every company will be an underperformer. But it does mean that sponsors need to now view almost every company within their portfolio as an uncertain-performer.

That’s unchartered territory, that brings to the fore a host of new challenges for sponsors:

- How do they address current portfolio instability en masse?

- How do they simultaneously assess multiple investments, individually?

- How do they identify the portfolio companies that will be most responsive to early and ongoing sponsor intervention?

Traffic Light Portfolio Categorization

The latter is a particularly critical question – because it recognizes that not all portfolio companies will be impacted equally. And, even if they are, not all companies will need similar levels of sponsor support. It also, frankly, recognizes that some investments will be so disproportionately impacted by the pandemic that the return on intervention might not equal or exceed the resources needed to do so. Some might just be too far gone. The essential sponsor step here, (in order to understand where and how to focus support), is to categorize their portfolio using a traffic light matrix:

- (Green) Healthy Portfolio Companies: These are the portfolio companies who are either stable, or are in industries seeing an uplift in demand (on the latter, think online retail, certain sub-sectors of healthcare, at-home personal fitness, etc.). Sponsor lift here will be around commercial excellence, pricing, inventory planning, etc.

- (Yellow) At-Risk Companies: Companies that are at risk of significant underperformance, but that, with effective cash management and value stabilization initiatives, can be saved. Sponsor lift here will be around liquidity management, 13-week cash flow forecasting, SG&A rationalization, contingency planning, and lender management. It will also consist of more operational initiatives like footprint optimization, SKU rationalization, and automation.

- (Red) Restructuring Situations: If we do our job right in the yellow zone, many companies can avoid the red. But, for those still nearing insolvency, sponsor lift will be heavy, consisting of many yellow bucket initiatives as well as interim and crisis management, and restructuring.

Accordion’s COVID-19 Framework

How can sponsors categorize/color-code their portfolio scientifically and strategically? And, how do they understand the real pandemic implications to their portfolio companies beyond just guesstimating?

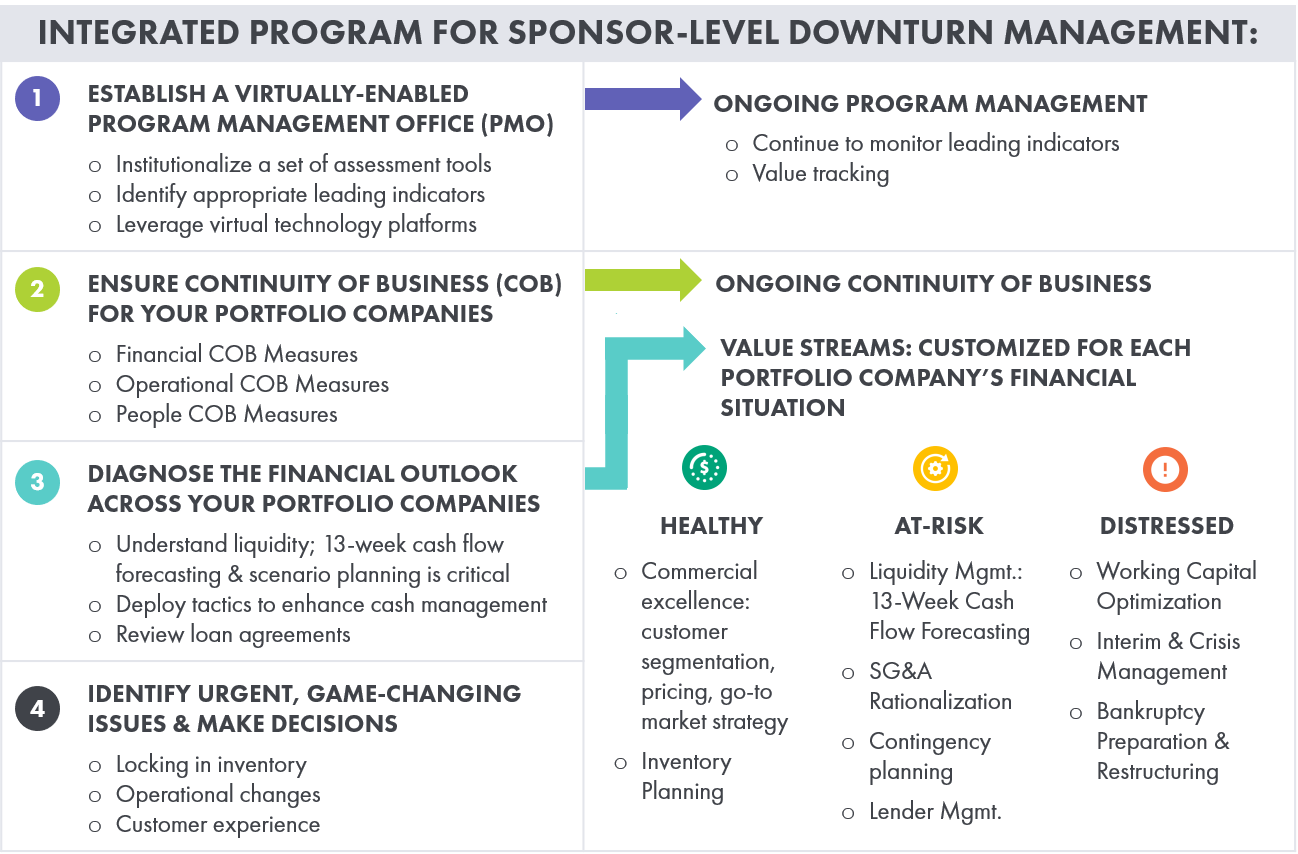

The path to green, yellow, red is not black and white. There’s no clear-cut approach, just as there are no true COVID-19 experts. We’re all learning as we go. But, at Accordion, there are experiences and expertise we can draw upon to help sponsors navigate this portfolio-wide undertaking – specifically, learnings from performance improvement scenarios from which we can develop a framework of integrated workstreams to help sponsors assess, categorize, and address their portfolio. As such, we’ve identified the 4 critical workstreams to enable portfolio categorization. They are:

- Workstream 1: Establish a Program Management Office (PMO)

- Workstream 2: Ensure Continuity of Business (COB) for Portfolio Companies

- Workstream 3: Diagnose the Financial Outlook Across the Portfolio

- Workstream 4: Identify the Game-Changers; Make Immediate Decisions