COVID-19: The Accordion Framework for PE Sponsors (Part II)

COVID-19: A Practical Framework for Private Equity (Part II)

By Nick Leopard, CEO & Founder, Atul Aggarwal, President, and Anthony Horvat, Managing Director

March was the beginning. It was the beginning wave of a novel pandemic’s crash to shore. For sponsors and their portfolio-backed CFOs, it was the beginning of intense, acute value stabilization efforts.

To support those client efforts, Accordion began applying our COVID-19 Framework (Part I) – a tool to help sponsors categorize their portfolio according to the traffic light matrix of green (healthy) companies, yellow (at-risk) investments, and those restructuring situations that are blinking red.

And now we’ve turned the page. If month-one was all about portfolio planning, assessing and diagnosing (with some necessary decision-making thrown in for good measure), month-two is all about doing.

So now the question begs: Do what, exactly? Here, sponsors may find our answer surprising: you need to live in the yellow.

Yes, you will, rightly, spend a substantial amount of time growing your greens and restructuring your reds. But, it is your yellows to which you must yield unprecedented time and focus. They have become the critical swing companies in your portfolio, playing an outsized role in overall fund performance (returns, carry, and fundraising).

This framework extension (Part II) focuses on the yellow: defining it, discussing its importance to the carry, and outlining the practical steps that sponsors and CFOs must each take to address it.

And, because this is not the last of it; because of the possibility of pandemic resurgence in the fall, or continued novel outbreaks, it’s important to memorialize the insights and plays to-date. This extension, therefore, also includes critical month-one learnings to inform future planning.

TABLE OF CONTENTS:

- Page 3: The Fight for Fund Performance: Focusing on The Yellow

- Page 5: CFOs: Managing The Yellow

- Page 8: Sponsors: Enabling Yellow Management

- Page 11: A 12-18 Month Yellow Company Program

- Page 13: (Addendum) Black Swan on Repeat: Memorializing Month-One

The Fight for Fund Performance: Focusing on The Yellow

The COVID recession is the black swan event of all black swan events. Coming on the heels of the longest bull market in history, it is also an event that will be navigated by many GPs with little experience managing through disruption, much less recession.

The PE industry has had the luxury of a largely green aggregate portfolio, thanks to a thriving macro economy. The return from the bulk of that portfolio has overshadowed the few underperformers such that PE has largely ignored those mistakes.

With a portfolio of uncertain performers, sponsors no longer have that luxury – they must now spend their time (money and resources) squarely in the yellow.

COVID-19: A Focus on The Yellow = A Strong Impact on Returns

The What: The yellow are those at-risk portfolio companies that may be saved, but only with immediate and effective action. If the green is all about growth, and the red is all about financials, the yellow is all about operations.

The Why: While the market disruption has made select companies greener (telemedicine, at-home fitness, etc.), it has created a sharply depressed performance outlook for many more organizations. As a result, the yellows have an outsized impact on fund performance, such that when a couple of yellows go dark, or fall to red, they diminish fund returns and associated carry (which also impacts future fundraising efforts).

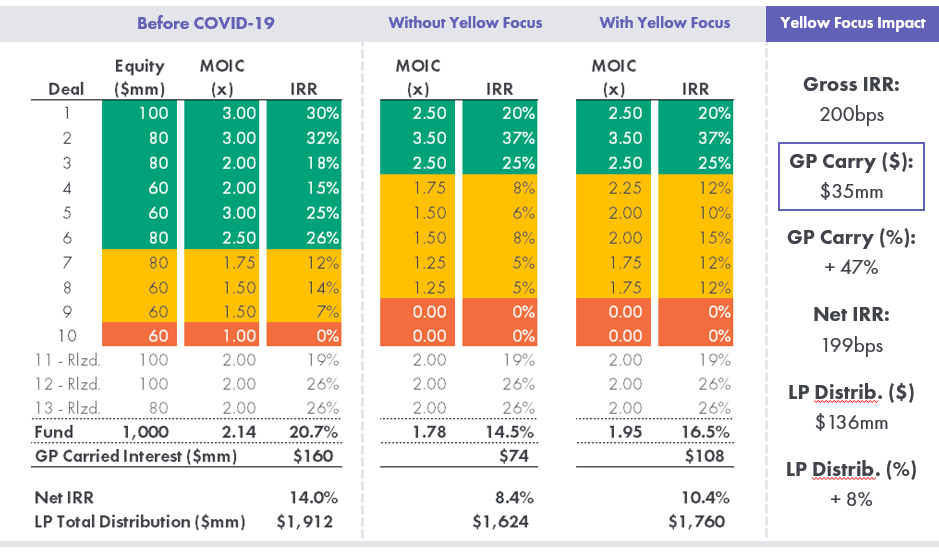

Figure 1: This graphic depicts a snapshot of a sample portfolio pre-COVID disruption. It is followed by projections of what happens to that portfolio when sponsors don’t lean in to their yellow, and the impact when they do. As illustrated, active sponsor engagement on yellow portfolio companies improves fund performance and GP carry.

COVID-19 Response

COVID-19 is having immediate and far-reaching implications on the private equity community. If you’re a sponsor, you’re seeing your healthy investments become at-risk companies. If you’re a CFO, you’re faced with tremendous uncertainty and the need to make critical decisions (and fast). Regardless of your role, you need help – with liquidity management, 13-week cash flow forecasting, SG&A rationalization, contingency planning, lender management, and, potentially, substantive restructuring support. At Accordion, our team is here to help with all of these areas (and more).

Explore Resource Center